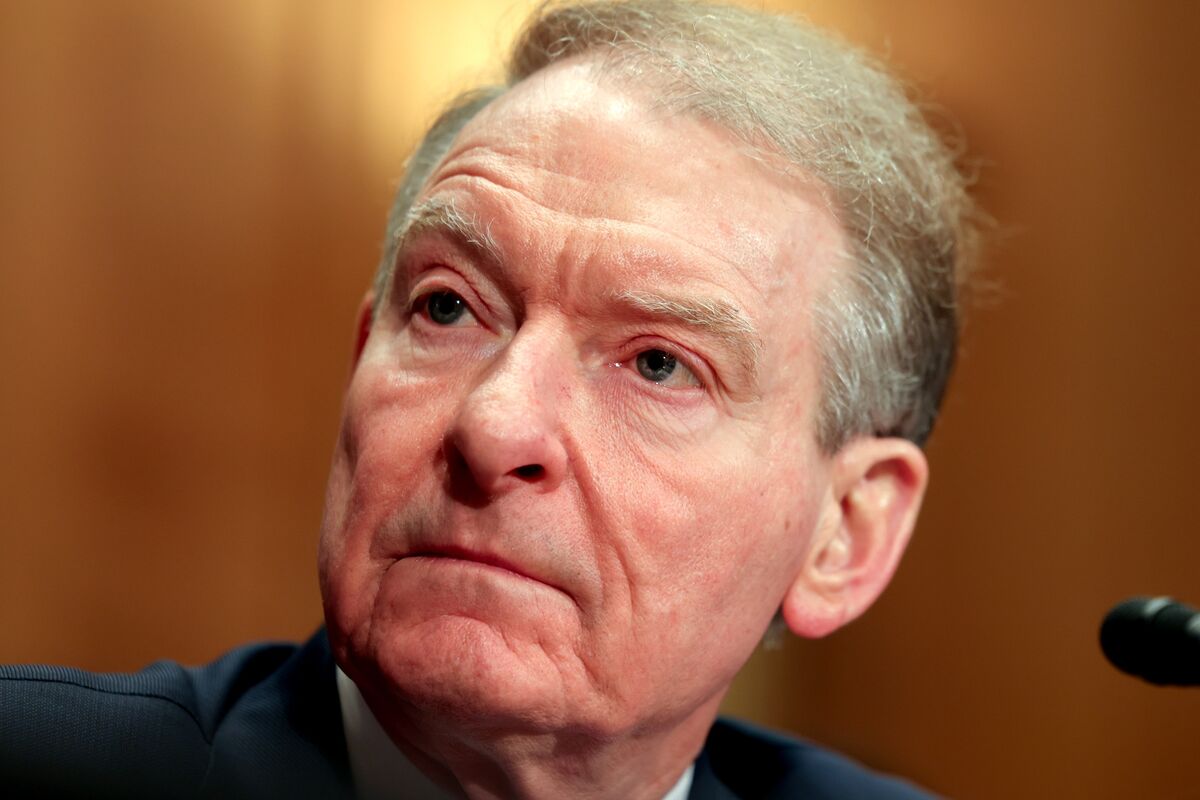

Atkins Confirmed: New SEC Chair's Impact on Markets & Regulations

Editor's Note: The confirmation of Jay Clayton's successor as SEC Chair marks a significant shift in regulatory oversight. This analysis explores the potential implications.

Why It Matters: The Securities and Exchange Commission (SEC) plays a crucial role in maintaining the integrity of U.S. financial markets. The appointment of a new chair carries significant weight, influencing regulatory priorities, enforcement actions, and investor confidence. This article reviews the confirmation of the new SEC Chair, analyzing its potential impact on market regulation, investor protection, and overall economic stability. We will explore key aspects of the appointment, examining its implications for various sectors and providing insights for investors and stakeholders.

Key Takeaways of SEC Chair Appointment:

| Takeaway | Description |

|---|---|

| Regulatory Shift | Potential changes in enforcement priorities and regulatory approach. |

| Market Impact | Analysis of the potential effects on stock prices, trading activity, and investor sentiment. |

| Investor Protection | Assessment of how the appointment may affect investor rights and protections. |

| Cryptocurrency Regulation | Examination of the new chair's stance on digital asset regulation. |

| Enforcement Actions | Predictions on the types of enforcement actions that may be prioritized. |

Atkins Confirmed: A New Era for the SEC

The confirmation of the new SEC Chair signals a potential shift in the agency's priorities and approach to regulation. Understanding the background and stated goals of the new chair is crucial for investors, businesses, and policymakers alike. The appointment's significance stems from the SEC's broad mandate encompassing everything from corporate disclosures and insider trading to market manipulation and the regulation of investment advisors. The new chair's perspective on these issues will inevitably shape the agency's agenda.

The Impact on Corporate Governance

The SEC Chair plays a vital role in shaping corporate governance standards. The new administration's approach to corporate governance will likely impact how publicly traded companies operate, influencing everything from executive compensation to shareholder rights. We'll examine the potential implications of the new chair’s views on corporate responsibility, transparency, and accountability.

Facets:

- Role: Sets regulatory agenda, oversees enforcement actions, and shapes the overall direction of the SEC.

- Examples: Past actions and statements indicating potential future policy directions.

- Risks: Potential for increased or decreased regulatory scrutiny, impacting various sectors.

- Mitigation: Understanding the new chair's priorities to anticipate potential regulatory changes.

- Impacts: Effects on corporate behavior, investor confidence, and market stability.

The Future of Cryptocurrency Regulation Under the New SEC Chair

The new SEC Chair's views on cryptocurrency regulation are of paramount importance to the burgeoning digital asset market. The approach taken by the SEC will greatly influence the development and adoption of cryptocurrencies and blockchain technology within the United States. We’ll analyze the potential consequences of different regulatory approaches, considering both the opportunities and challenges they present.

Further Analysis: The interplay between the SEC's regulatory framework and the innovative nature of the cryptocurrency market necessitates a nuanced approach. The potential for both increased investor protection and stifled innovation must be carefully considered.

Closing: The SEC's regulatory stance on cryptocurrencies will have far-reaching implications for the technology's future in the United States.

Information Table: Key Policy Areas and Potential Changes

| Policy Area | Potential Change Under New Chair | Impact |

|---|---|---|

| Corporate Disclosure | Increased or decreased emphasis on specific disclosures | Affects transparency and investor decision-making |

| Insider Trading Enforcement | Increased or decreased enforcement activity | Impacts market integrity and corporate behavior |

| Market Manipulation | Changes in surveillance and enforcement strategies | Affects fair trading and investor protection |

| Investment Advisor Regulation | Alterations to rules governing investment advisors and funds | Impacts investor protection and the investment management industry |

| Cybersecurity Regulation | Increased focus on cybersecurity for financial institutions | Improves data protection and reduces the risk of cyberattacks |

FAQ: Addressing Common Concerns

Introduction: This section addresses frequently asked questions concerning the new SEC Chair's appointment and its potential impact.

Questions:

-

Q: What are the potential benefits of the new SEC Chair's appointment? A: Potential benefits include a fresh perspective, renewed focus on specific regulatory areas, and improved efficiency in enforcement actions.

-

Q: What are the potential risks associated with the appointment? A: Potential risks include regulatory uncertainty, potentially disruptive policy changes, and shifting priorities away from certain crucial areas.

-

Q: How will the new SEC Chair impact investor confidence? A: The impact on investor confidence will largely depend on the specifics of the new chair's policies and enforcement actions.

-

Q: What industries are likely to be most affected by the new chair's policies? A: Industries likely to be most affected include financial technology, cryptocurrency, and publicly traded companies in general.

-

Q: Will the new SEC Chair prioritize specific regulatory initiatives? A: Based on past statements, certain priorities are likely, but the extent and nature of these priorities will become clearer over time.

-

Q: How can investors prepare for potential regulatory changes? A: Investors should stay informed about the new chair's policies and actions, and consider diversifying their investments to mitigate risks.

Summary: The FAQ section provided clarity on several key aspects of the new SEC Chair's appointment, addressing concerns about potential impacts, benefits, and strategies for investors to prepare for anticipated regulatory changes.

Tips for Navigating the Changing Regulatory Landscape

Introduction: This section offers practical tips for businesses and investors navigating the changing regulatory landscape under the new SEC Chair.

Tips:

- Stay Informed: Monitor official SEC announcements and industry news for updates on regulatory changes.

- Understand Compliance: Ensure your business practices comply with current and evolving regulations.

- Seek Expert Advice: Consult legal and financial professionals for guidance.

- Monitor Enforcement Actions: Pay attention to the SEC's enforcement actions to understand evolving priorities.

- Engage with Regulators: Participate in public comment periods and other engagement opportunities.

- Diversify Investments: Manage risk by diversifying your investment portfolio.

- Review Corporate Governance: Ensure your company's corporate governance practices align with SEC expectations.

- Develop a Contingency Plan: Prepare for potential shifts in regulatory priorities and their impact on your business.

Summary: These tips provide a strategic framework for businesses and investors to adapt to the changing regulatory environment and mitigate potential risks.

Summary of Atkins Confirmed: A New Era for the SEC

This article explored the appointment of the new SEC Chair and its wide-ranging implications for the US financial markets. The analysis covered anticipated regulatory shifts, potential market impacts, and considerations for investors and businesses navigating this new landscape. A detailed examination of various policy areas and their potential alterations provided insightful perspectives on the future direction of the SEC.

Closing Message (Mensaje de cierre):

The confirmation of the new SEC Chair ushers in a period of transition and potential change. Staying informed, adapting to evolving regulations, and engaging proactively with regulatory developments will be crucial for stakeholders across the financial sector. The long-term effects of this appointment will unfold over time, shaping the future of US financial regulation for years to come.