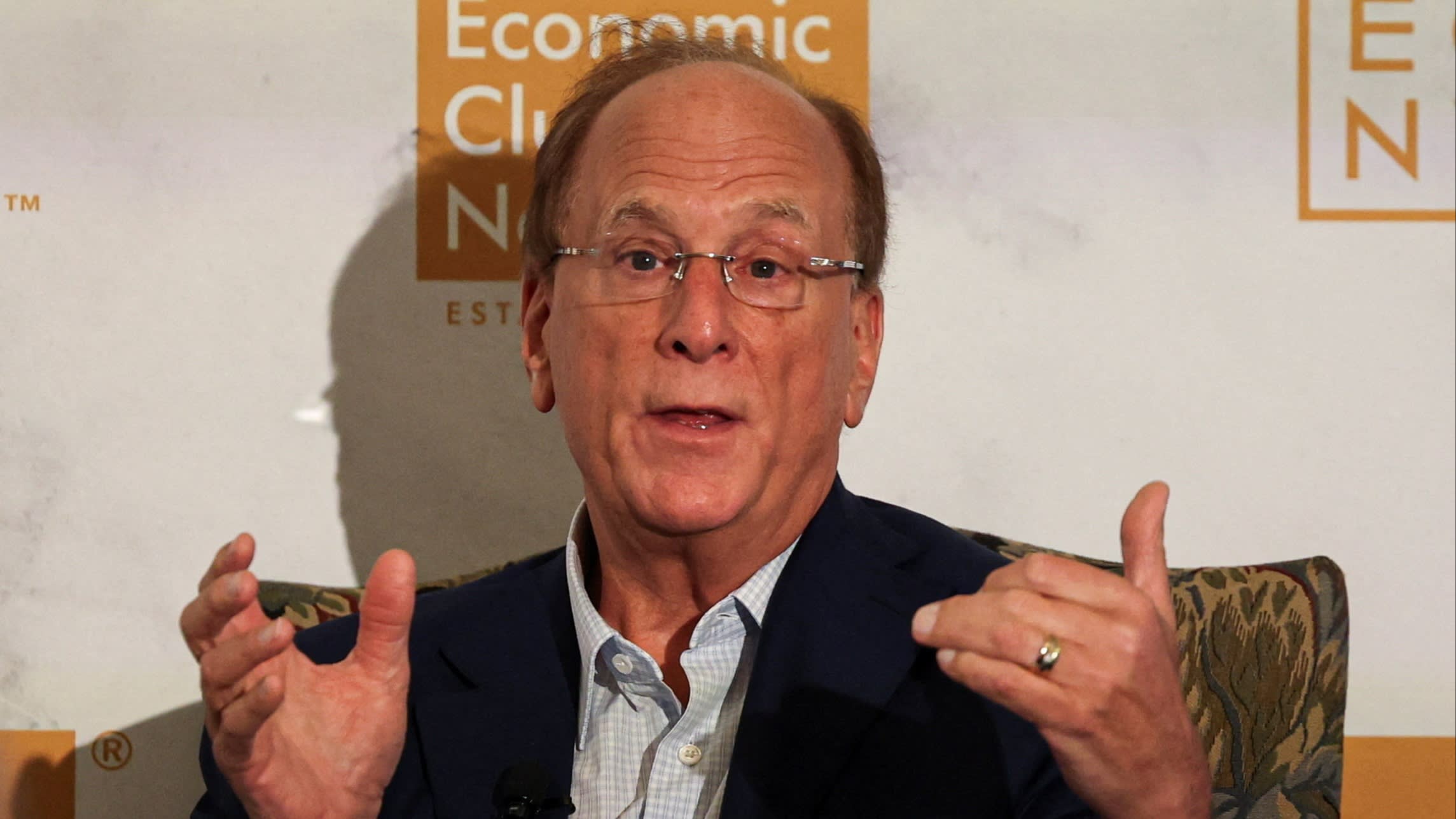

Title: BlackRock's Fink: Recession Fears & US Market Outlook – Key Insights

Editor's Note: BlackRock CEO Larry Fink's recent comments on the US economy have sent ripples through the financial world. This article delves into his concerns and offers crucial insights for investors.

Why It Matters: Larry Fink's pronouncements carry significant weight in the global financial markets. BlackRock, the world's largest asset manager, plays a pivotal role in shaping investment strategies. Understanding Fink's perspective on recession risks and the US market is crucial for investors navigating current economic uncertainty. This review analyzes his statements, examining related macroeconomic indicators, potential market impacts, and strategies for mitigating risk. We’ll explore key takeaways from his analysis, incorporating relevant semantic keywords like inflation, interest rates, market volatility, investment strategies, and economic forecast.

Key Takeaways of BlackRock's Recession Outlook:

| Takeaway | Description |

|---|---|

| Recession Probability High | Fink expressed heightened concerns about a potential US recession. |

| Inflationary Pressures | Persistent inflation remains a major concern, influencing monetary policy. |

| Interest Rate Impacts | Rising interest rates impact borrowing costs and investment decisions. |

| Market Volatility Expected | Fluctuations in the stock market are anticipated due to economic uncertainty. |

| Strategic Adjustments Needed | Investors should adapt their portfolios to navigate the challenging environment. |

BlackRock's Fink: US Recession Fears

Introduction: Recent statements from BlackRock CEO Larry Fink highlight growing concerns about a potential US recession. Understanding the nuances of his perspective requires examining the interplay of inflation, interest rate hikes, and their impact on market stability.

Key Aspects:

- Inflationary Pressures: Persistent inflation is a primary driver of Fink's concerns. High inflation erodes purchasing power and necessitates aggressive monetary policy responses.

- Interest Rate Hikes: The Federal Reserve's efforts to curb inflation through interest rate increases are a double-edged sword. While necessary to combat inflation, higher rates can stifle economic growth and increase borrowing costs.

- Market Volatility: The uncertainty surrounding inflation and interest rates contributes to increased market volatility. Investors grapple with navigating a challenging environment characterized by fluctuating asset prices.

- Investment Strategies: Fink's statements implicitly call for investors to adjust their strategies. Diversification, risk management, and a cautious approach become paramount in uncertain times.

Inflation and its Impact on the US Economy

Introduction: Inflation’s persistent rise is directly linked to Fink's recession fears. It significantly impacts consumer spending, business investment, and overall economic growth.

Facets:

- Role of Supply Chains: Disrupted global supply chains have contributed to higher prices for goods and services.

- Examples: Soaring energy prices and increased food costs are prominent examples of inflation's impact on consumers.

- Risks: High inflation can lead to decreased consumer confidence and reduced investment, potentially triggering a recession.

- Mitigation: Central banks aim to mitigate inflation through monetary policy adjustments, including interest rate hikes.

- Impacts: Inflation erodes purchasing power, impacting savings and retirement plans.

Summary: The persistent nature of inflation and its knock-on effects on the broader economy are key elements in Fink's cautious outlook. Addressing inflationary pressures is crucial to preventing a more significant economic downturn.

Interest Rate Hikes and Their Consequences

Introduction: The Federal Reserve's response to inflation, primarily through interest rate hikes, is intertwined with Fink's recessionary concerns. These hikes, while intended to curb inflation, can have unintended consequences.

Further Analysis: Higher interest rates make borrowing more expensive for businesses and consumers, potentially slowing down economic activity. This can lead to reduced investment, job losses, and ultimately, a recession. Furthermore, higher interest rates can strengthen the dollar, impacting global trade and potentially creating further economic headwinds.

Closing: The delicate balancing act between controlling inflation and avoiding a recession is at the heart of Fink’s concerns. The effectiveness of interest rate hikes in achieving this balance remains a critical question. The interconnectedness of monetary policy, inflation, and economic growth underscores the complexity of the current economic landscape.

Information Table: Key Macroeconomic Indicators and Their Implications

| Indicator | Current Status | Potential Impact on US Economy |

|---|---|---|

| Inflation Rate | Elevated | Reduced consumer spending, slower growth |

| Unemployment Rate | Relatively Low | Potential for increase due to economic slowdown |

| Interest Rates | Rising | Higher borrowing costs, reduced investment |

| Consumer Confidence | Declining | Reduced spending and economic activity |

| GDP Growth Rate | Slowing | Potential for recession if trend continues |

FAQ

Introduction: This section addresses common questions surrounding BlackRock’s recessionary concerns.

Questions:

-

Q: How likely is a US recession, according to Fink? A: Fink hasn't assigned a specific probability but expressed significant concern, suggesting a heightened likelihood.

-

Q: What are the primary drivers of Fink’s concerns? A: Primarily persistent inflation and the Federal Reserve's response through interest rate hikes.

-

Q: What can investors do to protect themselves? A: Diversify portfolios, focus on risk management, and consider more conservative investment strategies.

-

Q: Is a recession inevitable? A: Not necessarily, but the risk is significantly elevated, according to Fink's assessment.

-

Q: How long might a potential recession last? A: The duration of a potential recession is uncertain and depends on various economic factors.

-

Q: What role does geopolitical instability play? A: Geopolitical uncertainty adds to the overall economic instability and increases recessionary risks.

Summary: The FAQs highlight the uncertainty surrounding the US economy, emphasizing the need for careful financial planning and risk management.

Tips for Navigating Economic Uncertainty

Introduction: These tips offer practical guidance for investors and individuals navigating the current economic climate.

Tips:

- Diversify your portfolio: Spread investments across different asset classes to reduce risk.

- Rebalance regularly: Adjust your portfolio allocation to maintain your desired asset mix.

- Focus on long-term goals: Don't panic sell during market downturns.

- Manage your debt: Minimize high-interest debt to reduce financial vulnerability.

- Increase emergency savings: Build a financial cushion to weather economic storms.

- Consult a financial advisor: Seek professional guidance tailored to your specific circumstances.

- Stay informed: Keep abreast of economic developments and market trends.

Summary: Proactive financial planning and informed decision-making are crucial to mitigating the impact of economic uncertainty.

Summary of BlackRock's Recession Outlook

Summary: This article explored BlackRock CEO Larry Fink's concerns about a potential US recession. The analysis focused on the interplay of inflation, interest rate hikes, their impact on market stability, and the implications for investors. Key takeaways highlighted the need for strategic adjustments in investment portfolios and proactive financial planning.

Closing Message: (Mensaje de cierre): The economic outlook remains uncertain, demanding vigilance and adaptability. Proactive financial management and informed decision-making will be crucial in navigating the challenges ahead. Stay informed, stay adaptable, and consult with financial professionals for personalized guidance.