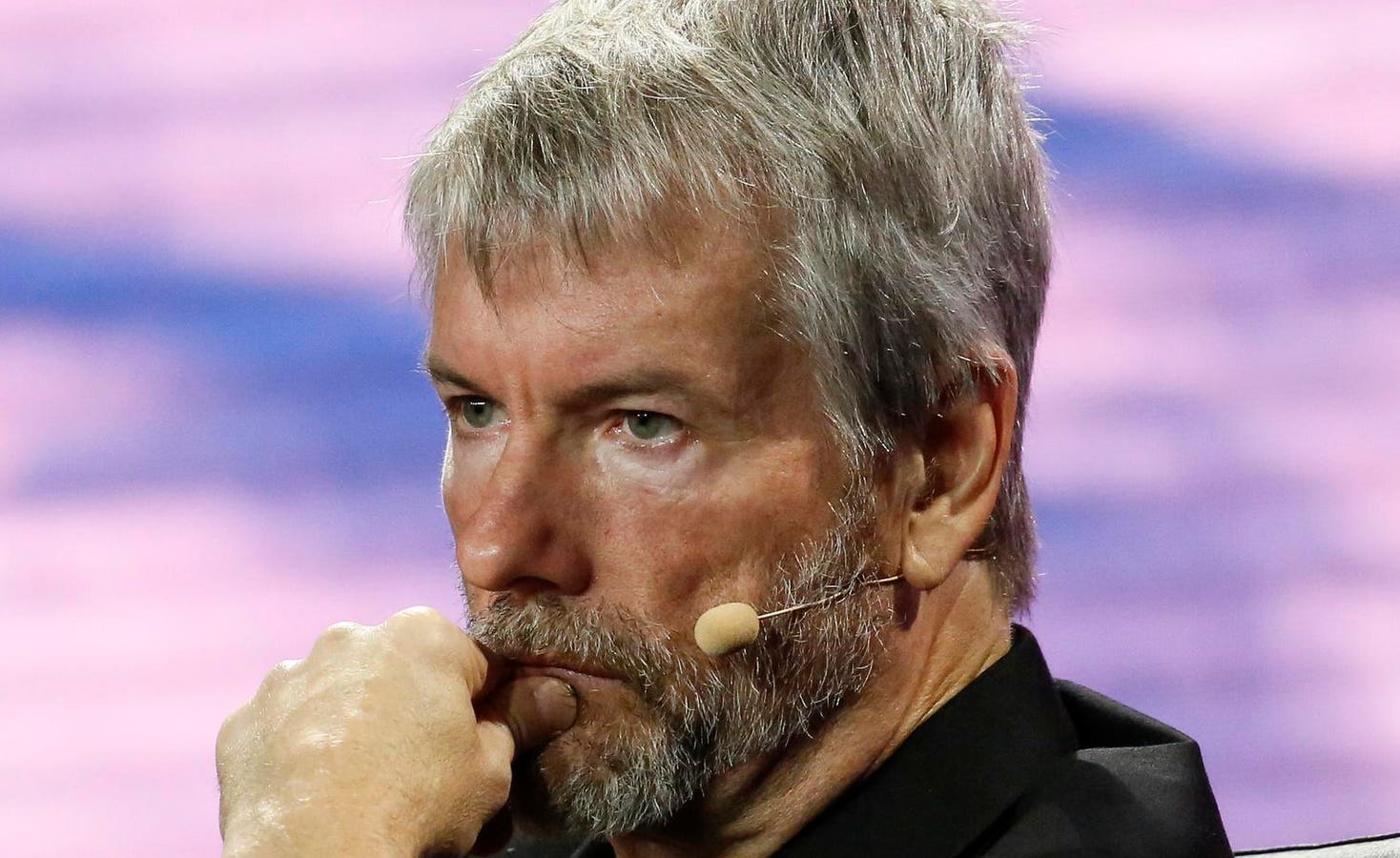

Title: Saylor's Bitcoin Warning: $10K Crash Imminent? New Insights & Analysis

Editor's Note: Michael Saylor's recent comments on Bitcoin's price have sent shockwaves through the crypto market. This in-depth analysis explores the potential for a significant price drop and offers crucial insights for investors.

Why It Matters: Michael Saylor, CEO of MicroStrategy and a prominent Bitcoin bull, issued a stark warning regarding Bitcoin's price. Understanding the potential implications of his prediction – a potential crash to $10,000 – is crucial for anyone invested in or considering investing in Bitcoin. This analysis delves into the factors contributing to Saylor's concern, exploring macroeconomic trends, regulatory pressures, and Bitcoin's on-chain metrics to provide a comprehensive overview.

Key Takeaways of Saylor's Bitcoin Warning:

| Takeaway | Explanation |

|---|---|

| Macroeconomic Uncertainty | Inflation, rising interest rates, and potential recession are negatively impacting risk assets like Bitcoin. |

| Regulatory Scrutiny | Increased regulatory pressure on cryptocurrencies could lead to price volatility and decreased investor confidence. |

| Bitcoin's On-Chain Metrics | Certain on-chain indicators might signal potential weakness in the market. |

| Potential for Price Correction | A significant price correction is possible, though the extent is debatable. |

| Long-Term Bitcoin Outlook | Despite the potential for a short-term correction, many still believe in Bitcoin's long-term potential. |

Saylor's Bitcoin Warning

Introduction: Michael Saylor's recent comments have ignited a debate within the cryptocurrency community regarding the potential for a substantial Bitcoin price drop. This section analyzes Saylor's warning, examining the supporting arguments and considering counterarguments.

Key Aspects:

- Macroeconomic Factors: Inflationary pressures and rising interest rates significantly impact investor sentiment towards risk assets like Bitcoin. A potential recession could further exacerbate the situation.

- Regulatory Uncertainty: Increased regulatory scrutiny of cryptocurrencies globally creates uncertainty and could lead to a sell-off. Stringent regulations can limit market accessibility and investor participation.

- Bitcoin's On-Chain Analysis: Certain on-chain metrics, such as the miner's capitulation and the market's overall sentiment, might suggest bearish signals. Analyzing these indicators provides a better understanding of the current market dynamics.

Discussion: Saylor's warning isn't solely based on speculation; it's rooted in observable macroeconomic trends and analysis of Bitcoin's market behavior. However, it's essential to consider that Bitcoin's price is influenced by numerous unpredictable factors. The extent of any potential price correction remains uncertain.

Macroeconomic Factors and Bitcoin

Introduction: The correlation between macroeconomic events and Bitcoin's price is undeniable. This section explores how factors like inflation and interest rate hikes influence Bitcoin's value.

Facets:

- Role of Inflation: High inflation erodes purchasing power, making investors seek alternative stores of value, potentially driving Bitcoin demand. Conversely, aggressive rate hikes by central banks aim to curb inflation, which could negatively impact Bitcoin's price.

- Examples: The 2022 bear market saw a strong correlation between rising interest rates and Bitcoin's price decline.

- Risks: Unforeseen economic downturns can significantly impact Bitcoin's price, as investors tend to divest from risk assets during periods of economic instability.

- Mitigation: Diversification of investment portfolios can help mitigate risks associated with macroeconomic fluctuations.

- Impacts: Macroeconomic instability can cause significant price volatility in Bitcoin, creating both opportunities and challenges for investors.

Summary: Understanding the impact of macroeconomic factors on Bitcoin's price is critical for informed decision-making. While inflation can drive demand, central bank actions aimed at combating inflation can negatively affect Bitcoin's performance.

Regulatory Scrutiny and its Impact on Bitcoin

Introduction: Increased regulatory scrutiny is a significant factor influencing Bitcoin's price. This section examines the impact of various regulatory frameworks on investor confidence and market activity.

Further Analysis: Different jurisdictions adopt varying approaches to cryptocurrency regulation. Stringent regulations can stifle innovation and limit market accessibility. Conversely, a more accommodating regulatory environment can foster growth and attract investment.

Closing: The regulatory landscape is constantly evolving. Keeping abreast of regulatory developments is crucial for navigating the cryptocurrency market effectively. The uncertainty surrounding regulation remains a significant source of both risk and opportunity.

Information Table: Key Market Indicators and their Potential Impact on Bitcoin Price

| Indicator | Current Status (Example) | Potential Impact on Bitcoin Price |

|---|---|---|

| Inflation Rate | 5% | Downward pressure |

| Interest Rates | Rising | Downward pressure |

| Bitcoin Mining Hashrate | Increasing | Potentially positive |

| Regulatory Uncertainty | High | Downward pressure, increased volatility |

| Global Economic Outlook | Uncertain | Significant impact, highly volatile |

FAQ

Introduction: This section addresses common questions surrounding Saylor's Bitcoin warning and its implications.

Questions:

- Q: Is Saylor's prediction guaranteed? A: No, price predictions are inherently speculative.

- Q: What other factors could impact Bitcoin's price? A: Technological advancements, adoption rates, and geopolitical events.

- Q: Should I sell my Bitcoin? A: This is a personal decision depending on your risk tolerance and investment strategy.

- Q: Is a $10,000 price point realistic? A: It's possible, but the extent of any price correction is uncertain.

- Q: What are the long-term prospects for Bitcoin? A: Many still believe in Bitcoin's long-term potential as a decentralized store of value.

- Q: How can I mitigate the risk of a price drop? A: Diversification and a long-term investment strategy.

Summary: The FAQs highlight the complexities of predicting Bitcoin's price and the importance of individual risk assessment.

Tips for Navigating Bitcoin Volatility

Introduction: This section offers practical tips for navigating Bitcoin's price volatility.

Tips:

- Dollar-Cost Averaging (DCA): Invest regularly regardless of price fluctuations.

- Diversify Your Portfolio: Don't put all your eggs in one basket.

- Only Invest What You Can Afford to Lose: Cryptocurrency is inherently risky.

- Stay Informed: Keep up-to-date on market trends and news.

- Develop a Long-Term Strategy: Don't make impulsive decisions based on short-term price movements.

- Use Stop-Loss Orders: Minimize potential losses.

Summary: These tips emphasize a disciplined approach to Bitcoin investing, minimizing risk and maximizing potential returns.

Summary of Saylor's Bitcoin Warning

Summary: This article explored Michael Saylor's Bitcoin price warning, analyzing the underlying macroeconomic factors, regulatory pressures, and on-chain metrics contributing to his concern. While a significant price correction is a possibility, the actual extent remains uncertain. The long-term outlook for Bitcoin remains a subject of debate.

Closing Message: Navigating the cryptocurrency market requires caution, informed decision-making, and a well-defined investment strategy. Continuous learning and adaptability are essential for successfully navigating the inherent volatility of the crypto space.