Tokyo Stocks Rise: Unveiling the US Trade Impact

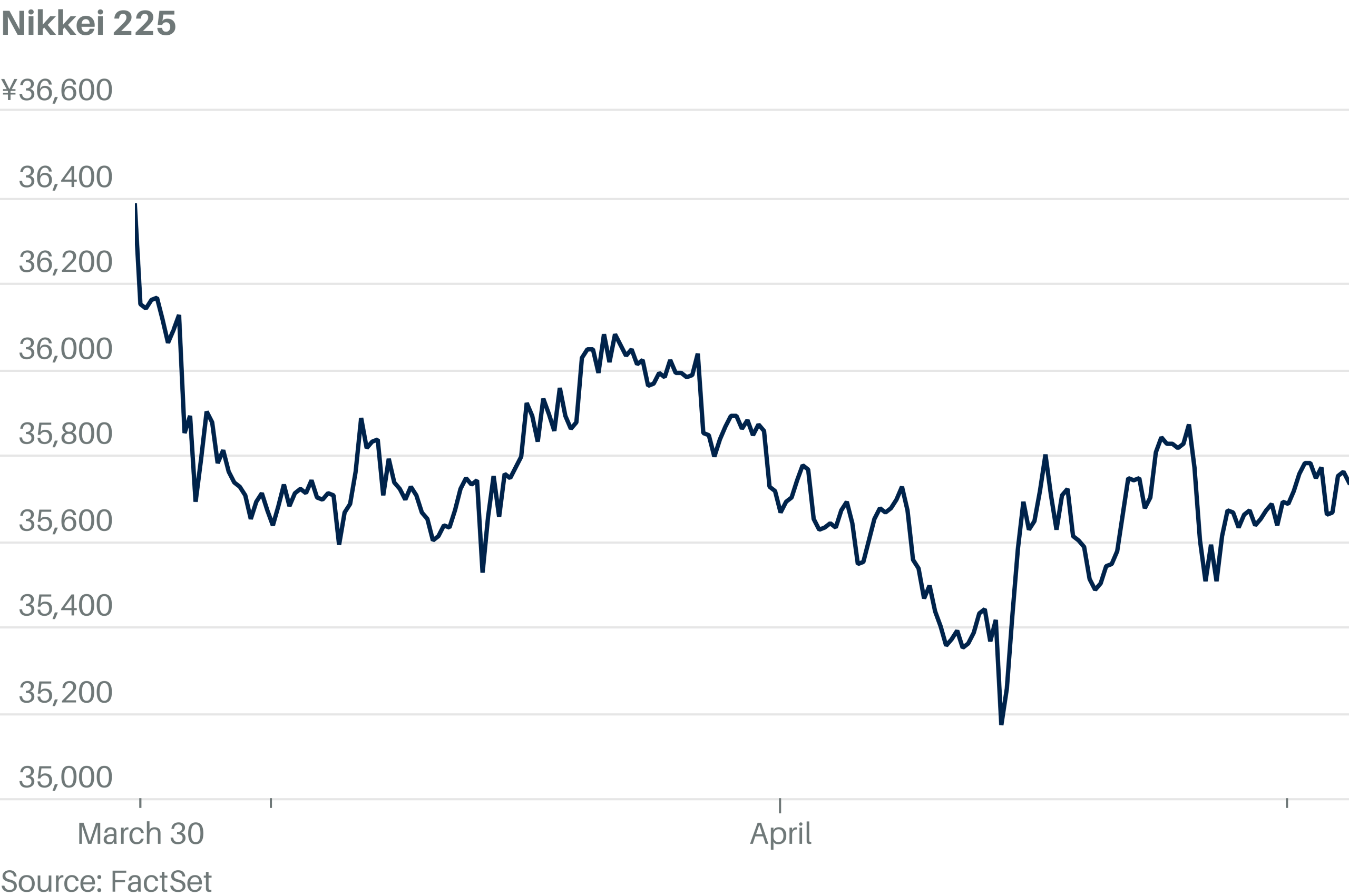

Editor's Note: Tokyo's Nikkei 225 index saw a significant surge today. This article delves into the reasons behind this rise, focusing on the influence of US trade developments.

Why It Matters: Understanding the interplay between US trade policy and the performance of the Tokyo Stock Exchange is crucial for investors, economists, and anyone interested in global market dynamics. This analysis explores the recent market shift, examining its drivers and potential long-term implications for Japanese businesses and the global economy. Keywords include: Tokyo Stock Exchange, Nikkei 225, US Trade, Japanese Economy, Market Volatility, Global Trade, Investment Strategy, Economic Indicators.

Key Takeaways of Tokyo Stock Rise:

| Factor | Impact on Tokyo Stocks |

|---|---|

| Positive US Trade Data | Increased investor confidence |

| Weakening Yen | Boosted export prospects |

| Improved Global Sentiment | Increased foreign investment |

| Speculation on Future Growth | Market optimism |

Tokyo Stocks Rise: Unpacking the US Trade Influence

Introduction: The recent rise in Tokyo stocks, particularly the Nikkei 225, is largely attributed to positive developments in US trade policy and improved global economic sentiment. This interconnectedness highlights the global nature of modern financial markets.

Key Aspects: The key aspects impacting this rise are the effects of US trade data, the Yen's fluctuations, shifting global sentiment, and speculation about future economic growth.

US Trade Data and its Ripple Effect

Introduction: Positive US trade data often serves as a leading indicator for global market performance. Stronger-than-expected export numbers or reduced trade deficits generally translate to increased investor confidence worldwide.

Facets:

- Role: US trade data provides insights into the health of the global economy, impacting investor sentiment.

- Examples: Positive US trade figures often lead to increased investment in riskier assets, including Japanese stocks.

- Risks: Negative US trade surprises can trigger rapid market corrections.

- Mitigation: Diversification of investment portfolios can help mitigate risks associated with US trade fluctuations.

- Impacts: Increased investment flows into the Japanese market, leading to higher stock prices.

Summary: The positive impact of US trade data on Tokyo stock prices highlights the interconnected nature of global markets and the importance of monitoring international economic indicators.

Yen's Weakening and Export Boost

Introduction: A weaker Yen relative to the US dollar can significantly benefit Japanese exporters. This is because their products become more price-competitive in international markets, leading to increased sales and profits.

Further Analysis: The recent weakening of the Yen has been a significant contributing factor to the rise in Tokyo stocks. Companies heavily reliant on exports, such as automotive manufacturers and electronics firms, are particularly well-positioned to benefit from this trend.

Closing: Understanding currency fluctuations is crucial for analyzing the performance of Japanese stocks. The Yen's movement directly influences the competitiveness of Japanese exports and, consequently, the profitability of many listed companies.

Global Sentiment and Foreign Investment

Introduction: Positive global sentiment, often fueled by positive economic news from major economies, attracts foreign investment, further boosting stock prices.

Facets:

- Role: Improved global outlook increases risk appetite, encouraging investment in emerging markets like Japan.

- Examples: Positive news from the US or European Union often stimulates foreign investment in Japanese markets.

- Risks: Negative global events can quickly reverse this positive sentiment, impacting stock prices.

- Mitigation: Consistent monitoring of global economic indicators is crucial for investors.

- Impacts: Increased capital inflows into Japan's stock markets, driving price appreciation.

Summary: Global sentiment is a critical factor influencing investment decisions, and positive developments in major economies frequently lead to capital inflows into the Japanese stock market.

Information Table: Key Economic Indicators and their Impact

| Indicator | Value (Example) | Impact on Tokyo Stocks |

|---|---|---|

| US Trade Balance | $50 Billion Surplus | Positive |

| Yen/Dollar Exchange Rate | 1 USD = 145 JPY | Positive (for exporters) |

| Nikkei 225 Index Closing | 33,000 | Positive |

| Global Manufacturing PMI | 52 | Positive |

FAQ

Introduction: This section addresses common questions concerning the recent rise in Tokyo stocks.

Questions:

- Q: How long will this upward trend in Tokyo stocks likely last? A: The duration is uncertain, dependent on numerous factors including continued positive US trade data, Yen stability, and global economic conditions.

- Q: Are there any risks associated with this market increase? A: Yes, risks include potential reversals in US trade data, unexpected Yen appreciation, and global economic downturns.

- Q: Should I invest in the Japanese stock market now? A: This is a personal decision based on risk tolerance and investment goals. Consult a financial advisor.

- Q: What other factors influence Tokyo Stock Exchange performance? A: Corporate earnings, government policies, and geopolitical events all significantly affect stock prices.

- Q: How does this rise in Tokyo stocks impact the average Japanese citizen? A: It can lead to increased retirement fund values and increased wealth, but the impact varies greatly depending on individual investment strategies.

- Q: What are the long-term prospects for the Japanese economy? A: Prospects are mixed, with challenges including an aging population and a shrinking workforce.

Summary: The future performance of Tokyo stocks hinges on various interrelated economic and political factors, both domestic and international.

Tips for Investing in Tokyo Stocks

Introduction: This section offers practical tips for navigating the Tokyo stock market.

Tips:

- Diversify: Don't put all your eggs in one basket; diversify your investments across various sectors.

- Research: Conduct thorough research before investing in any individual stock.

- Monitor the Yen: Track Yen fluctuations as they significantly impact Japanese exports.

- Stay Informed: Follow global and Japanese economic news closely.

- Consider ETFs: Exchange-Traded Funds (ETFs) offer diversified exposure to the Japanese market.

- Consult Professionals: Seek guidance from a financial advisor before making major investment decisions.

Summary: Careful planning and risk management are essential for successful investing in the Tokyo stock market.

Summary by Tokyo Stocks Rise

Summary: This analysis explored the recent rise in Tokyo stocks, attributing it primarily to the positive impact of US trade developments, the weakening Yen, increased global sentiment, and speculation about future growth. The intricate relationship between US trade policy and Japanese market performance underscores the interconnectedness of the global economy.

Closing Message: (メッセージを締めくくります) The future performance of Tokyo stocks will continue to depend on numerous factors. Staying informed about global economic trends and individual company performance is crucial for investors seeking opportunities in this dynamic market.